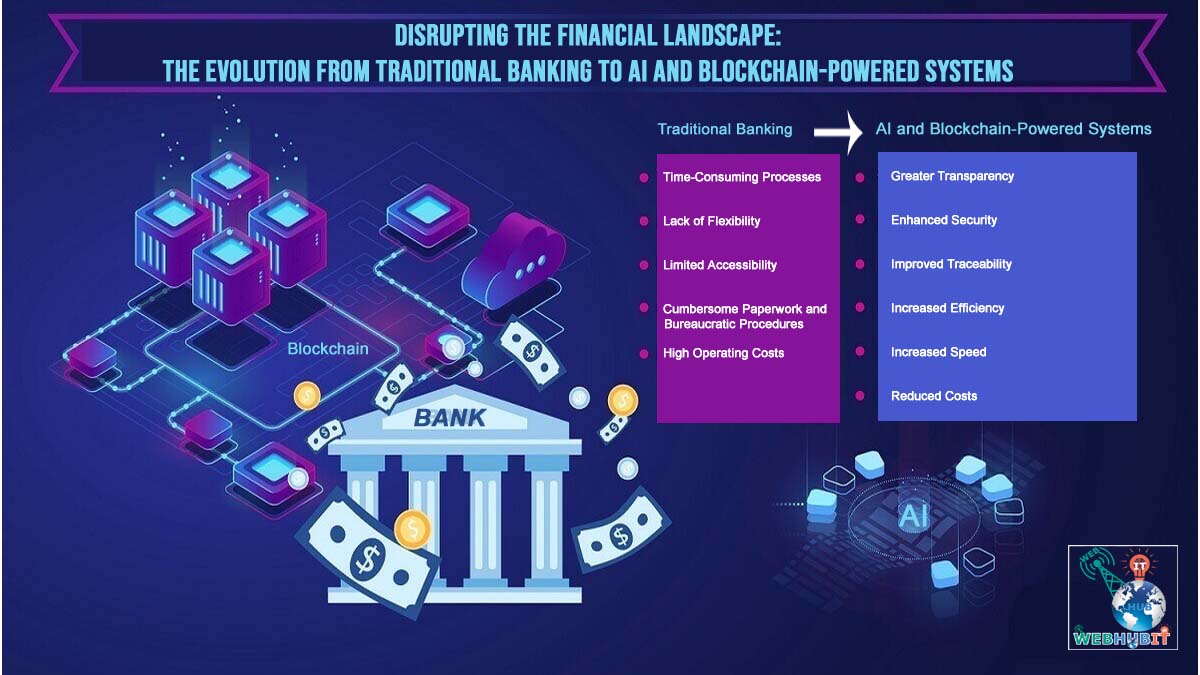

In recent times, the banking sector landscape has been subject to remarkable changes, driven primarily by the rapid development of technological capabilities. Traditional banking systems characterized by manual processes and cumbersome paperwork are being replaced by innovative AI and blockchain-powered solutions. In this article, we will explore the shortcomings of traditional banking systems and how AI and blockchain technologies are revolutionizing the financial landscape.

Challenges of Traditional Banking Systems

1. Time-Consuming Processes

Traditional banking systems often involve manual intervention, leading to time-consuming processes. Tasks such as account opening, loan processing and transaction settlement can take days or even weeks to complete, resulting in customer frustration and inefficiencies.

2. Lack of Flexibility

Traditional banks may struggle to adapt to changing customer needs or market dynamics due to rigid systems and outdated infrastructure. This lack of flexibility can hinder innovation and limit a bank’s ability to provide personalized services to its customers.

3. Limited Accessibility

Access to banking services may be limited to physical branches or specific channels, excluding individuals who cannot access these facilities. This limitation hinders financial inclusion and creates barriers for disadvantaged communities.

4. Cumbersome Paperwork and Bureaucratic Procedures

Cumbersome paperwork and bureaucratic processes are inherent in traditional banking systems, contributing to inefficiencies and delays. Customers are often required to fill out extensive forms and provide numerous documents, making the process long and frustrating.

5. High Operating Costs

Traditional banking systems can be expensive to operate due to overhead costs including maintaining physical infrastructure, staffing, and compliance with regulatory requirements. These costs are ultimately passed on to customers in the form of fees and charges.

Advantages of AI and Blockchain-Powered Banking Systems

1. Greater Transparency

AI and blockchain-powered banking systems provide greater transparency through decentralized ledgers that record every transaction. Participants can track and verify transactions in real-time, increasing trust and accountability in the financial system.

2. Enhanced Security

Blockchain technology uses cryptographic techniques to secure transactions, reducing the risk of fraud or data manipulation. By decentralizing data storage and implementing strong encryption methods, AI and blockchain-powered systems provide better security than traditional banking systems.

3. Improved Traceability

Every transaction recorded on the blockchain can be traced back to its origin, allowing for better auditing and compliance. This level of traceability enhances regulatory compliance and facilitates investigation of suspicious activities, ultimately reducing financial crimes.

4. Increased Efficiency

AI-powered algorithms and smart contracts can automate various processes within the banking system, streamlining operations and reducing manual errors. Tasks such as identity verification, credit scoring and contract execution can be performed more efficiently, resulting in cost savings and an improved customer experience.

5. Increased Speed

Transactions on blockchain networks can occur almost instantly, eliminating delays associated with traditional banking systems. Be it cross-border payments, securities trading, or fund transfers, AI and blockchain-powered systems enable faster transaction speeds, increase liquidity, and reduce settlement times.

6. Reduced Costs

Discover the cost-saving benefits inherent in AI and blockchain-powered banking systems. By leveraging these technologies, financial institutions can streamline operations, reduce overhead expenses, and increase overall efficiency. AI algorithms automate routine tasks, reducing manual labor and potential errors. Blockchain ensures secure, transparent transactions, eliminating the need for intermediaries and associated costs. Together, these innovations reduce operating expenses, helping banks allocate resources more effectively while providing better services to customers. Explore the transformative impact of AI and blockchain on banking’s bottom line.

In summary, The transition from traditional banking systems to AI and blockchain-powered solutions represents a significant shift in the financial industry. While traditional banking systems suffer from inefficiencies and lack of transparency, AI and blockchain technologies provide innovative solutions that overcome these shortcomings. By providing greater transparency, enhanced security, better traceability, increased efficiency and faster transaction speeds, AI and blockchain-powered banking systems are reshaping the way financial services are delivered and consumed. As these technologies mature and become widely adopted, the future of banking looks to be more transparent, secure, and efficient than ever before.